Quickbooks is a great accounting package that many nonprofits start out with. However, you may be finding that it is starting to fall down under the demands your organization needs. Here are a few signs you may have outgrown Quickbooks.

- Fund accounting and restricted funds reporting may not be meeting your needs

- Quickbooks was not designed with fund accounting in mind. It takes a lot of work to keep these funds in balance with Quickbooks. You can use classes to help but it is a poor substitute for a good ERP system.

- Grant accounting is being managed in spreadsheets.

- Quickbooks doesn’t have functionality for keeping up with Grant start and stop periods and where your grants stand on an up to the moment basis. Another problem with Grants is that they usually cross over your fiscal year. For instance, your grant period may run from September 16, 2016 to September 15, 2017 while your fiscal year is January to December. This is tough to manage in Quickbooks.

- Your staff need up to the minute information on their reporting areas, but ONLY their areas.

- Quickbooks has a very difficult time providing live reporting on a specific segment of the Organization without providing access to all parts. You might like for a person who has oversight over a particular department to see insights into their department but you want to withhold access to other sensitive areas.

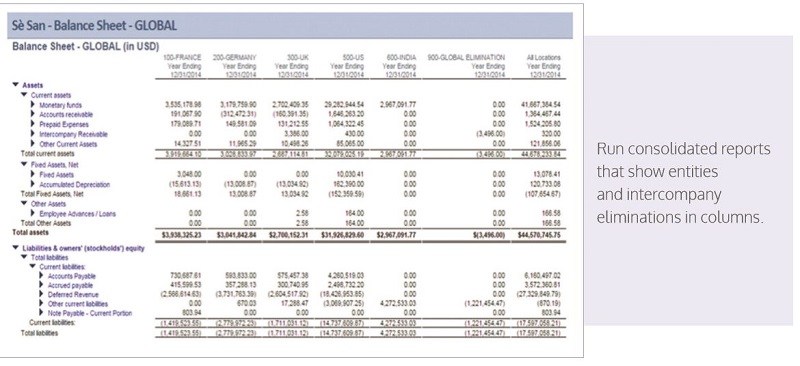

- Reporting on Multiple Entities Has Become Tedious

- If your Organization consists of multiple entities, you will have a very difficult time combining the data into financial reports without moving the data to a spreadsheet. Quickbooks is designed for one stand-alone company.

- A good ERP system will keep your chart of accounts the same across entities and help you create combined reports with the click of a button.

- Approval Workflows Are Needed

- Quickbooks does not contain workflows for approvals of transactions. This can be important for approving purchase orders to invoices and many other situations. The right systems will help enormously. A common workflow among nonprofits is to have 2 signatures on checks. This often requires a treasurer or board member to come in on Fridays and sign checks.

- Imagine instead that approvals are all done electronically, the CEO does the final approval and then treasurer receives a notification to approve payment. The approval is actually done on a smartphone while at the beach!

- You Need Statistical Reporting

- One severe weakness in Quickbooks reporting is in the area of statistical reporting. If you would like a report that divides your income statement by patient days, hours worked or number of employees, you’ll have to dump it out to excel to perform this function.

Let Qbix help you get to that next level with our Business Process as a Service Platform using Intacct , go to QBIXas.com or call 478-787-0530 for a confidential, no obligation consultation.